What Does Your Property's Taxable Value look like in 5 years? Not Good - (If School Board DARES to Opt-Out of the Limit).

Come to Bartow School Board Monday Night 1/13/25 meeting - Tell the Bartow School Board - NO OPT OUT! Cartersville three Meetings start 1/10 (they want to "opt out" too!)

By David McKalip, M.D.

The Bartow School System is attempting to make you pay as much in property taxes as politically possible. Their mad increase in property tax collection every year is hurting homeowners. The State of Georgia passed a law that was overwhelmingly approved by Voters on 11/5 to prevent your taxable value from increasing more than the annual state inflation rate. But wait….

The Bartow County School System, wants to OPT OUT of the cap on the taxable value of your home! That is right, they can’t stand the idea of anyone limiting “their” revenue. They insist that if your house value goes up on paper (even if you don’t sell it) that you will be able to find more money to pay based on that paper home value.

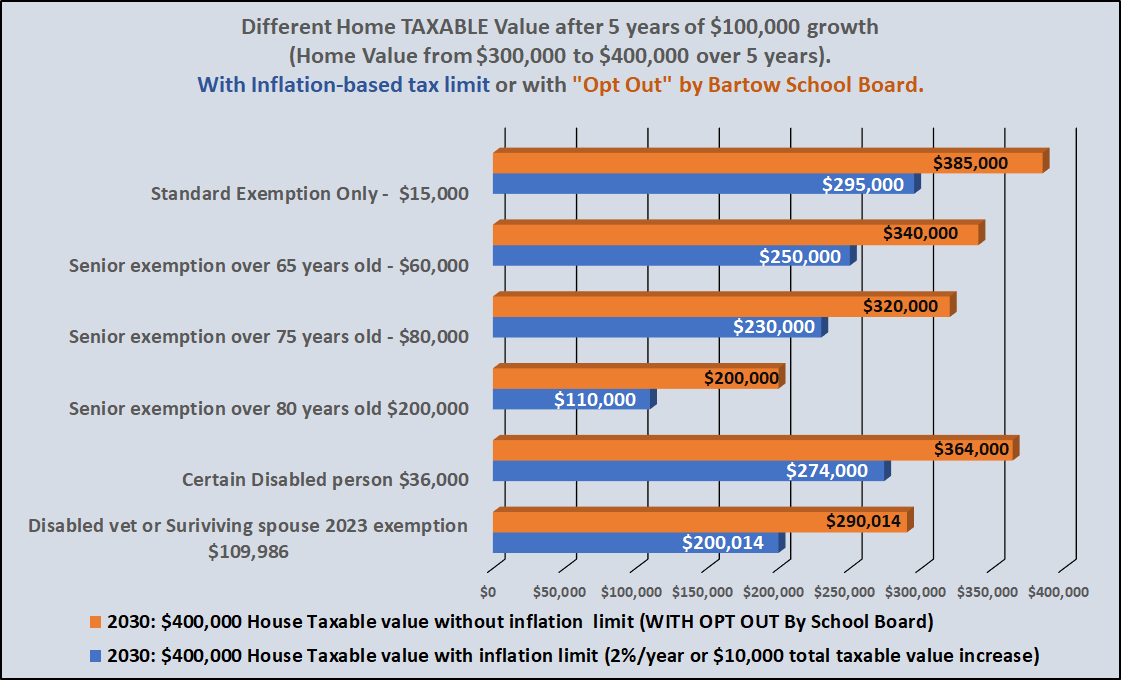

The Bartow Freedom Coalition has created an analysis of what a house’s taxable value would look like in five years if the school board votes to “opt out” (see below). In short, if the Board opts out, your taxes will increase much higher than inflation every year.

You can stop the Bartow County School Board from opting out…

Come to the BARTOW County School Board Meetings

Demand that they opt in to the state law allowing homestead value to go up no higher than state inflation.

Demand that they NOT adopt a sales tax to increase their revenue (in any case).

Insist that they cut spending, shrink administrative bloat and focus on education only.

Advise that you will will actively supporting a candidate against them when they run again if they choose to opt out of the homestead tax hike limitation.

MEETING TIMES (all at Bartow School System Admin building, 65 Gilreath Road, Cartersville).

PLEASE COME 15 minutes in advance, or register early by emailing tonya.poe@bartow.k12.ga.us (form for speaking) or calling 770-606-5800, Ext. 3838 and speaking to Tonya Poe by noon before the day of the meeting.

Monday, January 13, 5:30 pm

Tuesday, January 21, 11:30 am

Monday, January 27, 2025 6 pm

ALSO - please email your School Board members and let them know they should NOT opt out of the Tax hike limit passed by voters and approved by the legislators.

tony.ross@bartow.k12.ga.us; darla.williams@bartow.k12.ga.us; matt.shultz@bartow.k12.ga.us; butch.emerson@bartow.k12.ga.us; sharon.viktora@bartow.k12.ga.us

NOTE - CARTERSVILLE SCHOOL SYSTEMS WILL TRY THE SAME THING - See their meeting times below1.

Analysis of 5 year impact of School Board Opt-Out

I analyzed a scenario of how a home’s taxable value would be impacted by a bad decision by the board to “opt out” of the limit on increase of taxable value. Currently the School system rides the paper value of the home. So, as home values go up, they can pretend they didn’t hurt you by saying “the millage rate” was the same. Well, to anyone with a bit of math skills, let’s do the math: if your home value goes up by $100,000 but the tax rate stays the same from year to year, you will pay more property taxes. That has been the case here in Bartow since at least 2018 (longest data easily available from county).

The analysis conducted here evaluates the impact of a $100,000 increase in the value of a home from $300,000 to $400,000 over 5 years. It takes into account the exemptions currently available to homeowners. The analysis here is for Bartow Schools which has as different set of exemptions for seniors (max exemption is $60,000 for all over 65 for Cartersville, and better for County senior citizens). But the analysis works for seniors for Cartersville at the $60K level of exemption.

The analysis determines the limited growth in a home’s taxable value over 5 years with and without the negative impact of a school board opt-out.

For those who are not seniors and not disabled, the total taxable value after five years would be $295,000 after a presumed limit vs $385,000 without the limit. That is based on applying the standard exemption of $15,000 to most homeowners and then applying the inflation based-limit. In this scenario, a 2% annual inflation rate was presumed over 5 years for a total of 10% ALLOWED increase in home’s taxable value.

Clearly, citizens paying property-taxes will be much better off if the growth in taxable value is limited. That is why it is so important to STOP the OPT OUT!

Don’t worry about the school system. They have raised the tax collections 11-21% per year since 2018 and have $108 million in reserves. The kids will have plenty of resources even with a limitation in growth to no more than inflation. If the Board wanted higher collections, they would then be FORCED to raise the millage rate and stop hiding behind the shield of growth in paper value of a house.

Hope to see you at the School Board meetings!

In FREEDOM!

Cartersville School System Public meeting to support “opting out” of the homestead tax hike limitation (Board Room, 15 Nelson St, Cartersville, GA):

1/10/25 11am (will snow, so if they cancel they will be required to move the date)

1/21/25 5 pm

2/3/25 6 pm

Talking points:

Demand that they opt in to the state law allowing homestead value to go up no higher than state inflation.

Demand that they NOT adopt a sales tax to increase their revenue (in any case).

Insist that they cut spending, shrink administrative bloat and focus on education only.

Advise that you will will actively supporting a candidate against them when they run again if they choose to opt out of the homestead tax hike limitation.