TAXMAGEDDON! Even MORE Local Government Taxes Proposed to Skyrocket!

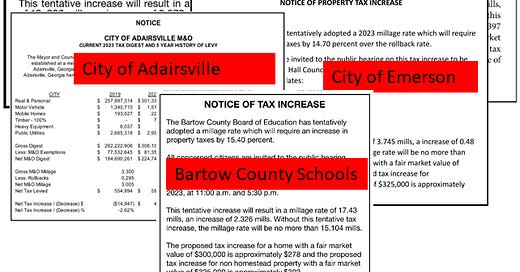

City of Cartersville, Cartersville Schools, Emerson, Adairsville and Bartow County Schools.

The local governments are on the warpath to raise taxes. With the exception of Bartow County government it appears nearly every local government is going to bring double digit percentage tax hikes to you. The fight is now raging at the Bartow County School Board. But WAIT, there’s MORE!!! See the list of hikes and HOW YOU CAN FIGHT THEM below.

To have any chance of stopping these tax hikes, you need to show up and testify at these meetings. If you are a resident of the taxing district, show up. If you have a business there, show up! If you are a consumer there, show up! All these tax hikes will be passed on to you one way or another. When property taxes go up on a business, the cost is passed to customers through higher prices. When property taxes go up on rental properties, rents go up. The ramifications are for more than just the owner of the property being taxed. So show up if you do ever patronize a benefit in the areas below even if not a resident.

The individual governments’ tax hike information and public hearing dates/locations are below.

For tips and ideas on speaking see 1)these 2)recent 3)posts. In general here are good talking points/ideas

The government should live on a limited budget just like the citizens who support the government.

The government needs to cut spending.

People are suffering with high inflation, increased federal taxes, increased utility bills for electricity, gas and water.

The elected officials need to go to the “ROLL BACK” RATE (the rate at which taxes will stay the same as last year, or cut taxes. Don’t just ride the wave up of higher property values. That is on paper only for us. We have no extra money to give.

We aren’t fooled by games of “not raising” or “lowering” the millage rate. As property values go up, we are STILL TAXED more, which is why you are advertising a “Notice of Property Tax Increase” according to the law!

No excuses. NO passing the buck. No political ideas of things that may or may not happen in 3-5 years. Do YOUR Job now and avoid ANY Tax hike now.

Look at your reserve funds and draw from those for any current urgent matters.

Look at excess and “gold-plated” health insurance coverage and retirement benefits that your staff get that the taxpayers themselves could never afford.

The politicians who offer you lame excuses and happy talk and then vote to raise your taxes need to be replaced. Especially if they ran as “small government conservatives”. Primary season is here. Will you step up and run? The City of Cartersville registration to run for City council is here and is between 8/21-8/24. https://www.cityofcartersville.org/city-clerk/page/municipal-elections

Cartersville School Board

(proposed) PERCENT TAX HIKE: 22.7%! Dollar amount UNKNOWN - that data is not available on the Cartersville Finance department website. Requests for information have been made.

TOTAL PERCENT INCREASE in revenue to city schools (not available online) - likely about 27-29%

Public meeting is a Third floor of City Hall on 10 North Public Square as follows:

8/9 5 pm, 8/17 8 am and 7 pm (note, same meeting time/location given for both City of Cartersville and Cartersville City schools, even though they are different entities. Make sure you testify to each entity separately and are given equal time for each)

City of Cartersville

(proposed) PERCENT TAX HIKE: 21.4%, Dollar amount increase $1.149 million.

TOTAL PERCENT INCREASE in revenue to city - 26.99%

Public meeting is a Third floor of City Hall on 10 North Public Square as follows:

8/9 5 pm, 8/17 8 am and 7 pm (note, same meeting time/location given for both City of Cartersville and Cartersville City schools, even though they are different entities. Make sure you testify to each entity separately and are given equal time for each)

City of Emerson

(proposed) PERCENT TAX HIKE: 14.7% Dollar amount increase: $113,173

TOTAL PERCENT INCREASE in revenue to city - 26.99%

Public meeting: Emerson City Hall Council Chambers, 700 Highway 293, Emerson, GA 30137 on the following dates:

August 7, 2023 at 9:00 am

August 7, 2023 at 6:00 pm

August 14, 2023 at 6:30 pm

City of Adairsville

(proposed) PERCENT TAX HIKE: 16.34% Dollar amount increase: $111,906

Public Hearing on Budget and tax hike: A public hearing will be held Tuesday, August 8th at 6:30 P.M. at City Hall.

To set new millage rate: Thursday, August 10th at 7:00 P.M. in City Hall at 116 Public Square, Adairsville, Georgia.

Bartow County Schools

(proposed) PERCENT TAX HIKE: 15.4%

MORE DETAILS 1)these 2)recent 3)posts.

Public Meeting: 65 Gilreath Road Cartersville, Georgia 30121

August 14th at 11 am and 5:30 p.m.

The politicians who offer you lame excuses and happy talk and then vote to raise your taxes need to be replaced. Especially if they ran as “small government conservatives”. Primary season is here. Will you step up and run? The City of Cartersville registration to run for City council is here and is between 8/21-8/24. https://www.cityofcartersville.org/city-clerk/page/municipal-elections

After attending the most recent Bartow County school board meeting and witnessing firsthand the seeming indifference of that board to the many intelligent, informed and heartfelt pleas of so many of our Bartow residents concerning the ongoing yearly tax increases, I have to wonder what continuing to simply show up at these meetings and playing by the rules as far as protesting their actions is going to accomplish. The very fact that they already voted on this millage rate in front of us before even hearing one of what the many people who showed up for that meeting had to say should tell you all you need to know about the county's (including the school board) interest in how our residents feel about this and their willingness to incorporate any kind of comprise based on what's fair to us. I don't honestly know what the answer is, but it seems obvious we need some stronger form of protest that will send a message that enough is enough, and that if they need additional funding, they need to look to those who are profiting from all this new development and driving up the county's collateral costs. They need to be confronted with more consequential actions that will drive home the fact that Bartow homeowners are not some rich uncle they can just keep coming back to year after year for ever more money. Politely repeating your complaints to a mute governing board who doesn't bother to respond is apparently not the answer.