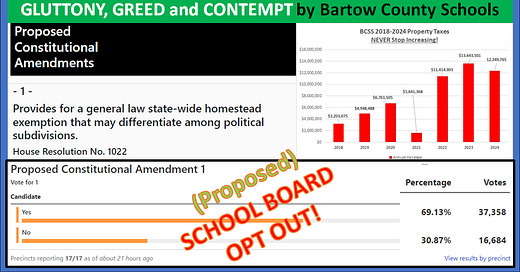

Bartow School System to Refuse State Law Limits on Property Tax Hikes. (Cartersville too!)

Come to Bartow School Board Meetings to try to change their minds: 1/13, 1/21 and 1/27.

“Gluttony: 2. greedy or excessive indulgence”

“Greed : a selfish and excessive desire for more of something (such as money) than is needed”. (Merriam Webster Dictionary)

Gluttony and Greed. Those are the best ways to define the motivation behind the proposed actions of the Bartow County School Board as they plan to opt out of the Homestead Exemption approved by local and state voters in the November. This state-passed Homestead Exemption would limit the amount of property taxes a local government can take from you - based on the paper value of a house increasing. Homeowners don’t have an extra 10-20% income hike every year, but the school system does and they want it to stay that way.

The greed and gluttony is obvious as the school board is now sitting on top of a record amount of “savings” in “their” (ours) school board reserve fund/bank account. Their revenue and spending continuously increase, along with the bank account. This means they are stashing money away from the revenue and not spending it on students. They state they are trying to have a “cushion” for future needs, but they just have greed and gluttony at the expense of the taxpayer. The school Board will have $108 million of your tax dollars in the bank at the end of the 2025.

Come to the BARTOW County School Board Meetings

Demand that they opt in to the state law allowing homestead value to go up no higher than state inflation.

Demand that they NOT adopt a sales tax to increase their revenue (in any case).

Insist that they cut spending, shrink administrative bloat and focus on education only.

Advise that you will will actively supporting a candidate against them when they run again if they choose to opt out of the homestead tax hike limitation.

MEETING TIMES (all at Bartow School System Admin building, 65 Gilreath Road, Cartersville).

PLEASE COME 15 minutes in advance, or register early by emailing tonya.poe@bartow.k12.ga.us (form for speaking) or calling 770-606-5800, Ext. 3838 and speaking to Tonya Poe by noon before the day of the meeting.

Monday, January 13, 5:30 pm

Tuesday, January 21, 11:30 am

Monday, January 27, 2025 6 pm

Property taxes have gone up over 11-21.4% per year since 2018 (10.88-21.4%/year). The school board is trying to prevent them from only going up at the rate of Georgia inflation, which would be about1-2% this coming year. They have too much greed and gluttony to prevent their fat tax hikes every year. In their announcement they said they need to keep up with inflation. Well they have done that well beyond even inflation, enough to keep $108 million in reserves along the way.

They complain in an announcement that they are “balancing financial responsibility with educational excellence”. Well, they certainly have not been financially responsible as they have soaked the taxpayers to fatten their reserves, and bloat their administrations. There are also open questions about educational excellence based on overall student performance, a recent downtick in enrollment and the efforts to defend obscene materials in the school libraries and classrooms. (Cartersville School System will also be attempting to opt out! Their meeting schedule is below1).

Bartow Citizens Demanded Homestead Exemption Property Tax Relief in 11/5 Election

Over 69% of Bartow county citizens voted for Georgia Constitutional Amendment #1. That action means that the assessed value of a person’s primary residence they own will not go up more than the rate of inflation in the state.

The 2024 state inflation rate was about 1.3%. That means your property taxes would not go up by more than 1.3% if this law were in place for the 2024 tax year.

Bartow helped AMMEND OUR STATE CONSTITUTION because four out of five members of the school board continue to hike the property tax collections by large percentages (except Darla Williams). They have done this over and over for at least six years in a row. all based on the artificial "paper” value of the house’s assesed value.

Contempt as well as Gluttony and Greed

Contempt (Merriam Webster)

1 a : the act of despising : the state of mind of one who despises : disdain

b : lack of respect or reverence for something

2 : the state of being despised

3 : willful disobedience to or open disrespect of a court, judge, or legislative body contempt of court

Contempt is really the only way to explain the attitude that enables the gluttony and greed of the Bartow school system. They know the citizens want lower taxes. They just don’t care. They talk of offering tiny crumbs (like a $5,000-$15,000) homestead exemption. That would cut the taxable value of a $300,000 house to $285,000. If that house grew to $400,000 in five years, it would still be taxable at $385,000.

But this $5-15,000 exemption is a small percentage of the exemption that could be achieved by a limitation based on state rate of inflation. The new exemption would be far higher, depending on the value of the house. For instance, If the house grows in value by $100,000 over 5 years, that would limit the “TAXABLE VALUE” increase to no more than $10,000 if the rate of inflation was about 2%/year. So that would limit the tax growth by 90%. So that would make the taxable value of the same $300,000 house that grew over five years to $400,000 in paper value to no more than about $310,000 in TAXABLE Value. For some others (like seniors) they would enjoy the other exemption too (and their new taxable value after growth over 5 years would ALSO be no more than $310,000. That is much better than the crumbs of the current homestead exemption which would still tax a senior at $385,000 after five years. (Again, the school system’s celebration of not raising millage is irrelevant, since it is the inflated value of the house that is the basis of tax hikes).

But the majority of the School Board obviously doesn’t care. They don’t care that single mothers may not be able to afford the house they are in. Or that a growing family won’t be able pay the extra tax bills and afford to support the needs of their family. The School system doesn’t feel your pain. Why would they? “Their” bank act is bloated through their greed and gluttony as yours keeps getting drained.

We shall see if Matt Schultz, Tony Ross, Butch Emerson and new School Board Member Sharon Viktora do the right thing. Darla Williams has refused to go along with tax hikes every time she could. Let’s see if she will also keep that up.

So, please show up and tell these greedy, gluttonous, contemptuous “republican” school board members to vote NO on opting out of the constitutional homestead exemption! (SEE BARTOW DATES AND TIMES ABOVE).

In Freedom!

Cartersville School System Public meeting to support “opting out” of the homestead tax hike limitation (Board Room, 15 Nelson St, Cartersville, GA):

1/10/25 11am

1/21/25 5 pm

2/3/25 6 pm

Talking points:

Demand that they opt in to the state law allowing homestead value to go up no higher than state inflation.

Demand that they NOT adopt a sales tax to increase their revenue (in any case).

Insist that they cut spending, shrink administrative bloat and focus on education only.

Advise that you will will actively supporting a candidate against them when they run again if they choose to opt out of the homestead tax hike limitation.

69% voted for a provision that would allow an opt out. It was very plain in the text. If you can muster enough support, to get what you want out of this, good on you. But let's not pretend that the loophole wasn't there for everyone to see. No one should be shocked or surprised by this.

I assume the dates you wrote were in order. You wrote Jan 21 twice. The 2nd would be the 27th at 6pm. Just so you are aware that the body of the email has that mistake.