$12.3 Million Bartow County School Tax Hike Planned. Come Say "NO!" 7/29 5:30 pm, 65 Gilreath Rd.

The School Board wants to build more schools - many questions arise.

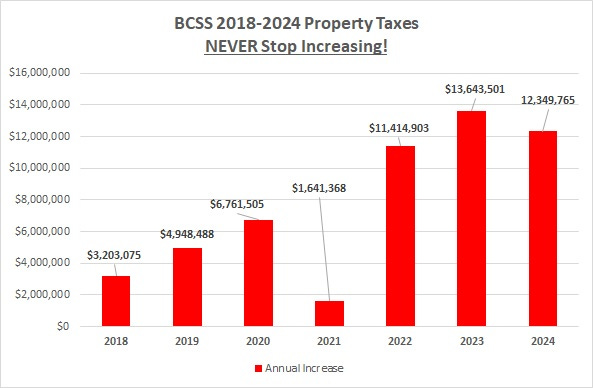

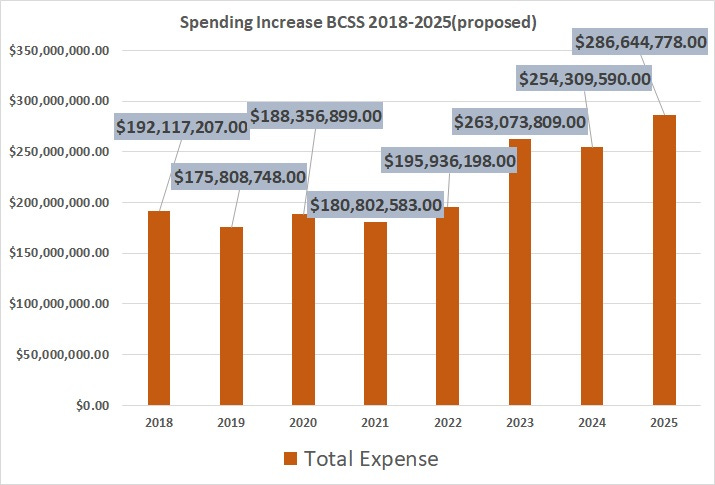

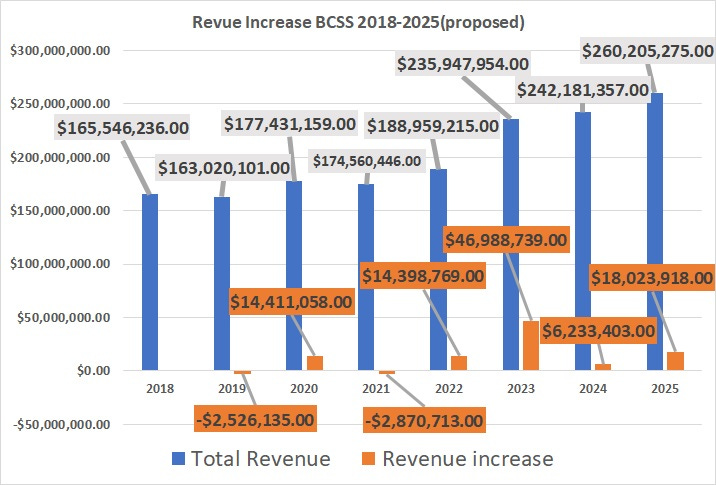

The School system continues to demand more money from you to pay for their out of control spending and big bank accounts. This blog predicted at least a $10 million property tax hike on June 13. Sorry, we were wrong. It is a $12.3 million tax hike! They are largely putting it into the School system “bank account” for “future needs”.

Those needs gained more clarification this week as the Bartow Freedom Coalition obtained documents that the plan is to build more schools for nebulous population growth projections. And the main projected growth demographic? “Hispanic” kids due to an influx of Hispanics in our county far beyond natural Hispanic population growth. That means local taxpayers will be likely be putting money in the school system bank account from their own bank accounts for the children of illegal aliens. More analysis on this later, but the data used to justify this does not seem to hold water (based on year 2000 fertility rates) and far overestimates building needs.

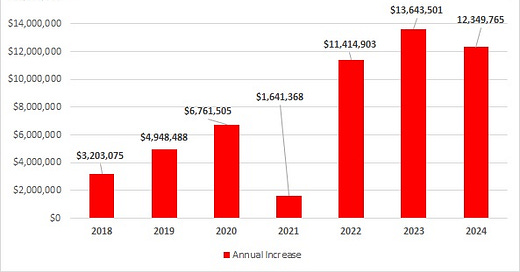

This $12.3 million tax increase is yet another increase that has been occurring year over year at least since 2018.

The citizens are going to have to revolt against this government overreach. Those Board members claiming to be “republican” need to act like it and actually oppose this tax hike. IN the past, only Darla Williams has done so. The rest are taking the name Republican but are acting like democrats with ever increased spending and taxation. Remember, the school system surveyed school insiders and staff to justify this, but did NOT interview the citizens! To no one’s surprise, the people that work at the schools WANT MORE OF YOUR MONEY!

The Bartow County School Board will meet on 7/29/24 at 5:30 pm to go through the routine motions of rubberstamping the massive, unnecessary tax hike. However, the School Board needs to hear from you. If you want to avoid a tax increase this fall, you need to ask them to oppose the millage rate and instead adopt the rollback rate.

Show up at 65 Gilreath Road by 5:15 to sign up to speak on 7/29/24.

Here are the ever increased spending and revenue charts

SHOW UP!

Georgia Code Title 20. Education § 20-2-167 (a)(5): " Each local school system may, however, establish a single reserve fund or reserve account intended to cover unanticipated deficiencies in revenue or unanticipated expenditures, provided that the budget for any year shall not allocate to such reserve fund or reserve account any amounts which, when combined with the existing balance in such fund or account, exceed 15 percent of that year's total budget."

Bartow County School System 2025 Budget has plans to have a budget surplus AGAIN. According to Bob Jackson this budget surplus is 29.2 percent.

This is a direct violation of Georgia code as it well exceeds the 15 percent.

Another portion of Georgia Code Title 20. Education § 20-2-167 (a)(5) explains why this is needed: "The purpose of this paragraph is to prohibit local school systems from accumulating surplus funds through taxation without accounting to the taxpayers for how such funds will be expended, and this paragraph shall be liberally construed to accomplish this purpose".

Link to Georgia Code Title 20. Education § 20-2-167. See section (a)(5)

https://codes.findlaw.com/ga/title-20-education/ga-code-sect-20-2-167.html